Get 2 months FREE of Proposal Pro and Consumer Management Portal!  Get Demo

Get Demo

Invoice

$42.53

Invoice

$42.53

Invoice Received

03/16/2020

Invoice Received

03/16/2020

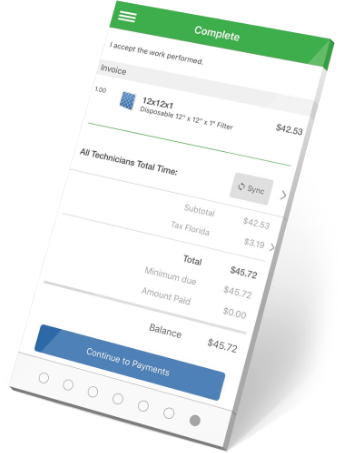

Easily connect a mobile card reader to your tablet or smartphone so your techs can accept payments at service appointments.

Once you take a payment in the field, it is immediately associated with an invoice and processed in FieldEdge and QuickBooks.

Avoid the extra time and human errors that come with recording payments in multiple systems.

Add FieldEdge Payments to your package and keep your cash flowing.

Request InformationClearent’s Compass® Online Reporting Tool provides transparent reporting and breaks down every transaction and fee on a statement, in comparison to other payment processors that provide vague and misleading statements.

Clearent’s terminal support team is ready to answer your questions quickly so you can get back to business.

Clearent is a full-service, payments solution provider with more than 400 employees, 45,000 merchants, and $16 billion in processing volume. From traditional point-of-sale terminals, mobile solutions, and tablet-based systems to a custom-built virtual terminal, eCommerce plug-ins, and hosted payments, Clearent helps small business owners securely accept payments just about anywhere. To learn more, visit clearent.com.